"At O’Neil Securities, I’m focused on helping clients achieve superior execution through data-driven solutions, seamless technology integration, and a partnership-oriented approach.”

Brian Williamson, Managing Director, Electronic Trading

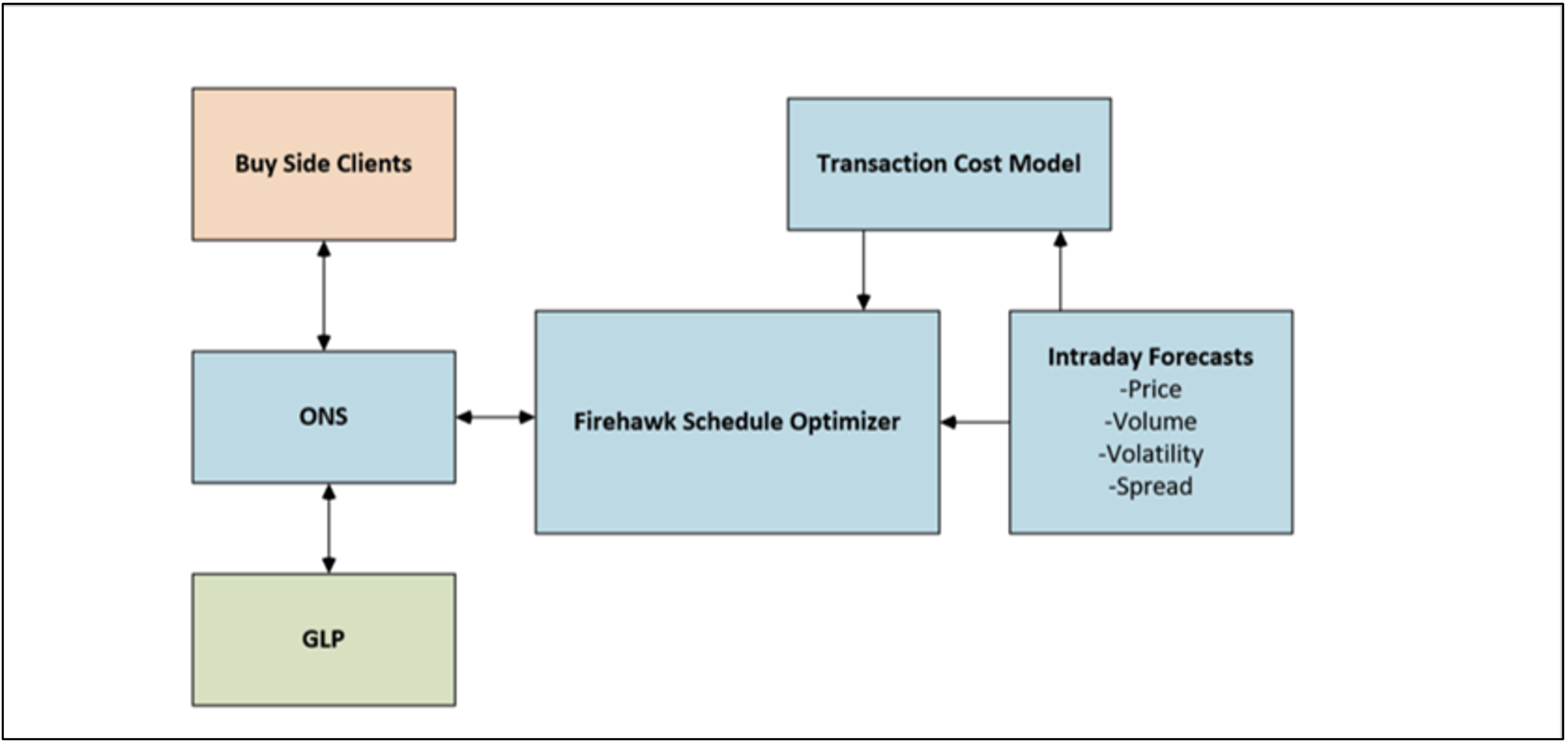

WOSET is William O’Neil’s AI-driven trading desk, built on decades of research to deliver alpha through real-time intelligence, adaptive execution, and deep liquidity access. It offers institutional-grade tools and proprietary O’Neil signals to enhance precision, control, and performance.

WOSET’s price predicting algorithm uses distinct trading signals for objective measurement. Formal research surveying 30k factors is backed tested with both our VWAP and TWAP algo’s to produce a schedule of trading that can speed up or slow down the algo, which could lead to significant outperformance versus both benchmarks.

Our vision is to provide the buyside with a unique algo designed for alpha generation based on our 60 years of factor research. It is our mission to consistently update and advance the technology for consistent returns over time.

Intelligent models that react instantly

Broad reach across liquidity pools

Real-time adjustments to market behavior

O'Neil signals driving performance

For customization and control

Formal research surveying 30k factors is backed tested with both our VWAP and TWAP algo’s to produce a schedule of trading that can speed up or slow down the algo, which could lead to significant out performance versus both benchmarks.